With our intelligence and entrepreneurship we create micro-chips and send crafts into space, but the creation of jobs for the disadvantaged seems out of reach. The rich countries in the world still have a huge pool of unemployment and poverty at the bottom of society. A close analysis gives the insight that we actually create unemployment and poverty ourselves.

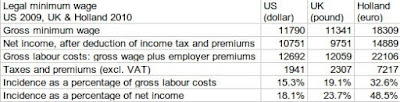

The following table gives the legal minimum wage in the US (dollars), in the UK (pounds) and in Holland (euros) as key examples for the rich world. The table is best understood from the principle of “don’t tax sweat”. That is, workers at the minimum should be exempt from levies.

The Dutch economist A.J. Cohen Stuart in 1889 (120 years ago) gave the perfect analogy: “A bridge must bear its own weight before it can carry a load.” In the same way a worker at the minimum cannot pay taxes since he or she must first earn subsistence. When levies are included then the cost of labour rises above productivity and the worker becomes unemployed – and must be supported by family or the dole.

As we can see in the table, the tax wedge at the minimum is 18.1% in the US, 23.7% in the UK and a huge 48.5% in Holland. This table disregards sales tax (VAT) so that the problem is actually bigger: eg, in the US another 8%.

The US estimate is from own calculation. The UK estimate is by courtesy of Mr Donald Hirsch and Mr Chris Goulden from the Joseph Rowntree Foundation. The Dutch data are from its Central Planning Bureau.

The legal minimum wage means that workers are not allowed to work below that wage. Hence, the taxes and premiums below the minimum wage are not collected either. Thus the tax wedge below the minimum wage is also a “tax void”. Levies are imposed but entirely fictional. The beauty of the tax void is that these levies can also be abolished overnight. What is not collected can also be abolished for free. By a rather simply measure we can create employment opportunities for large sections of the labour force.

Historically the tax void has arisen in three ways. Firstly, social insurance was enacted but this had no exemption, which is a logical error.

Secondly, tax exemption is internationally adjusted for inflation but subsistence rises with both inflation and the general rise in welfare.

Thirdly, over the last decades neo-liberal economists have been emphasizing lower marginal tax rates. This is because economic theory tells us that optimality is found with marginal analysis. For the UK for example the top marginal tax rate was 40% and becomes 50% as of April 2010, and economists tend to argue that this should be as low as possible.

However, this standard theory neglects dynamic changes over time. For dynamic optimality the analysis results into a dynamic marginal rate, that is close to the average rate. Marginal analysis remains important but gives a different conclusion. With high exemption a somewhat higher marginal statutory rate is acceptable as long as the average is acceptable. A full discussion of this can be found in my economic papers. Here it suffices to say that unemployment and poverty came about from an application of economic theory itself, but an inadequate theory. We can now understand how they have been so persistent in our societies that are so rich and creative in so many other ways.

Unemployment and poverty are not external events like earthquakes, but internal results of our economic system. They are evidence of errors in policy making. Since these errors are structural we must look for structural solutions. Within the realm of national decision-making, Montesquieu’s checks and balances of the executive, legislative and judiciary branches have failed.

We need a fourth branch, a scientifically based Economic Supreme Court, that checks the quality of the information used for decision making. The structural neglect of science in the political process has become too costly, not only for unemployment and poverty but for policy making in general.

* Thomas Colignatus is an econometrician in Scheveningen. His website is here.

‘The Independent View‘ is a slot on Lib Dem Voice which allows those from beyond the party to contribute to debates we believe are of interest to LDV’s readers. Please email voice(e)libdemvoice.org if you are interested in contributing.

Nessun commento:

Posta un commento