Putin’s Central Banker Is On a Tear

When Elvira Nabiullina

needed backing for a new phase in her crackdown—one that could hit some

of Russia’s biggest lenders—she went straight to the top. ‘I agree,’

said the president.

From Bloomberg Markets

In Russia, Peresvet Bank had an

edge no other big private financial institution could match. Its largest

shareholder was the powerful Russian Orthodox Church. In a 2015 pitch

to investors, Peresvet said the backing of the church and the bank’s

other big owner, Russia’s Chamber of Commerce and Industry, gave it a

“quasi-sovereign” status. For more than two decades, big state

companies stashed their cash with the bank, whose ponderous full

name—Joint Stock Commercial Bank for Charity and Spiritual Development

of Fatherland—suggested its grand standing.

Photographer: Arthur Bondar for Bloomberg Markets

Nabiullina, 53, has emerged as one of Putin’s most influential economic advisers following a low-key government career that began in the 1990s, before the Russian leader’s rise to power. Soft-spoken and unassuming, she runs what in Russia is called a “megaregulator.” When it comes to the economics behind Putin’s overarching goal of restoring Russia’s place in the world, there’s no one more influential.

As central bank governor, she’s in charge of a banking system whose weak links are an economic burden, driving up the cost of financing so badly needed in the face of stagnant growth. She’s also the chief guardian of Russia’s foreign currency reserves. Those holdings are more than just a tool of monetary policy; according to several senior officials, Putin views them as a vital safeguard of the country’s sovereignty.

For

now, the banks are at the top of her agenda. Nabiullina has said she

doesn’t have a target for how many she expects to survive. (She declined

to be interviewed for this story, which is based on interviews with a

dozen top officials and bankers, all of whom spoke on condition of

anonymity.) There’s clearly plenty of cleaning left to do. “About half

of all banks have holes in their capital,” says Mikhail Mamonov, an

analyst at the Center for Macroeconomic Analysis and Short-term

Forecasting in Moscow. Mamonov, brought in by the central bank to help

figure out how big the mess is, estimates the shortfall could be as much

as 3 trillion rubles ($50 billion), or about 3.5 percent of gross

domestic product. That’s almost twice what the central bank has spent on

the cleanup over the past three years.

Now the hundreds of smaller, privately owned ones are increasingly becoming a burden. Bailing out the failing banks has cost billions and done little to revive the lenders. Anastasia Turdyeva, an analyst at S&P Global, says she’s skeptical of the central bank’s handling of sick banks. “We have a lot of questions about how these decisions are made,” she says.

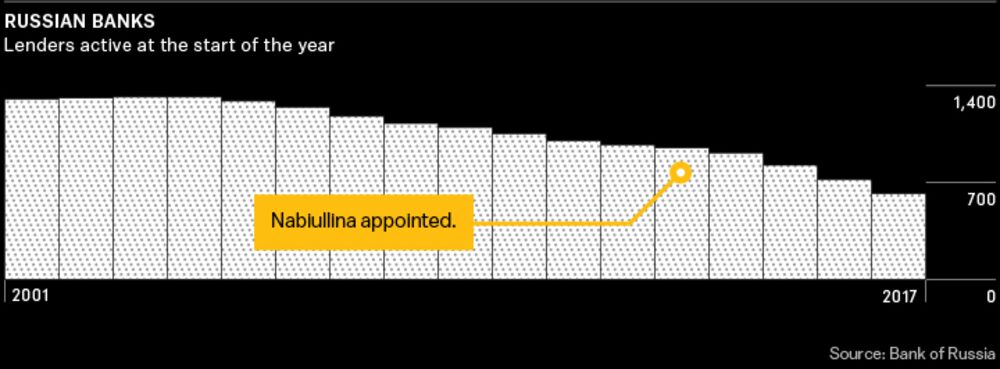

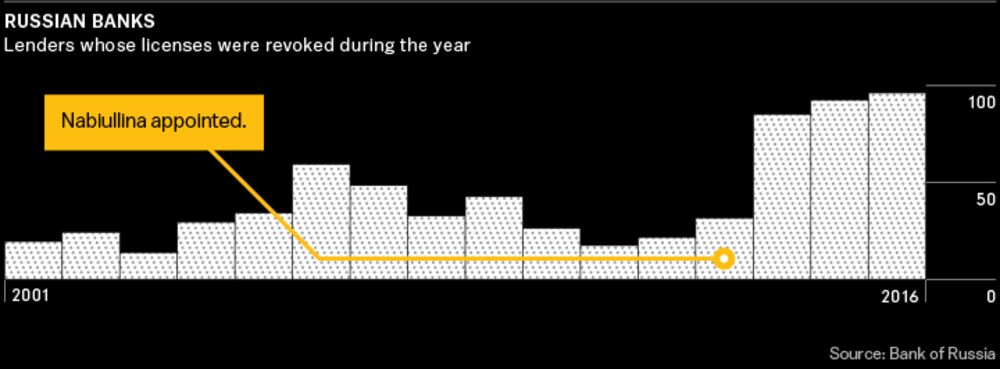

The last senior central bank official to mount a purge was killed by a hit man in central Moscow in 2006. Andrei Kozlov, central bank deputy chairman in charge of regulation, was shot to death on a September evening outside a Moscow sports stadium. He’d received death threats but brushed off extra security. Alexei Frenkel, who controlled four lenders whose licenses had been revoked by the central bank, was later convicted of paying $310,000 to have Kozlov murdered. After the killing, the cleanup slowed, with no more than a few dozen banks shuttered each year. But within months of taking over at the central bank in June 2013, Nabiullina stepped up the crackdown. And she had a peerless ally in the drive: the president.

Putin has taken to referring to Nabiullina by her first name, even in public, an unusual sign of familiarity. So last year, when she needed support for a new phase of the crackdown—one that could touch some of the country’s largest banks—she went straight to the top. In June she quietly appealed to him to back the new push, including changes in the law needed to make it possible. Shortly afterward she went public with her cleanup plan in a speech at a banking conference. Going directly to Putin was an unusual move. So much so that at a later meeting she apologized to her government colleagues for going over their heads, according to two people familiar with the encounter. The important thing was she had the magic words, scrawled in Putin’s sweeping script on the proposal she had presented to him: “I agree.”

Unlike

many other insiders, Nabiullina isn’t a longtime ally from St.

Petersburg, where Putin started his political career in the early 1990s.

An ethnic Tatar, Elvira Sakhipzadovna Nabiullina is the daughter of a

truck driver and a factory administrator from Ufa, a gritty industrial

city in Central Russia. She was a star student who learned French and

lived through books, memorizing the works of poets such as Paul Verlaine

and Anna Akhmatova. In the 1980s, she won a slot at Moscow State

University’s economics department.

While other veterans of that era were sidelined as the Putin government took power, Nabiullina found a place, helping reform czar Herman Gref write the new leader’s first economic program in 2000. In 2006, Nabiullina made a good impression on the president when she led preparations for Russia’s debut chairmanship of the Group of 8 summit, a milestone in Putin’s effort to restore his country’s international influence.

Although Putin expanded market reforms in his early years, he increasingly turned to state control. Yasin, Nabiullina’s former professor, publicly criticized Putin’s shift. But Nabiullina, ever the survivor, stayed on. In 2007, Putin promoted her to economy minister, a job once held by Yasin and then Gref. In 2012 she was one of just six senior government figures to return to the Kremlin with him when he was elected president for a third term. Despite her professorial manner, the bespectacled Nabiullina was known as a tough bureaucrat with a pragmatic, nonideological bent.

Ahead of Sergey Ignatiev’s retirement as central bank chief in 2013, Putin tapped her to help vet candidates for the position. Putin then surprised not only Nabiullina but also most of the Russian elite: He handed her the job.

Nabiullina’s first real test as central

bank governor came in late 2014. Since her appointment she’d been

focusing on arresting inflation, a task that kept her in the familiar

territory of academic economics. Even as the Kremlin was growing

suspicious about foreign influence in sensitive policy matters, she

turned to the International Monetary Fund for advice, going so far as to

arrange training seminars in global economics for central bank staff.

Nabiullina had no choice. The central bank freed the exchange rate and leaned on big state-run exporters to sell dollars to help stabilize the ruble. Then it imposed an emergency rate hike—a decision taken during a late-night meeting on Dec. 15, just days after senior bank officials had dismissed such a move as unnecessary. Initially, the ruble kept tumbling. Putin wasn’t impressed. At his annual press conference, two days after the rate hike announcement, Putin said, “There are questions about the timeliness and the quality of the measures taken.” It was a rare public slap-down of Nabiullina. Under pressure, she cut the responsibilities of a key ally, Kseniya Yudaeva, first deputy chairwoman of the central bank.

Then, early in 2015, the ruble steadied. Putin’s confidence in his central banker grew. Despite the stumbles, Nabiullina’s move to free the currency stanched the hemorrhaging of reserves that had cost the central bank $81 billion over 12 months. For Putin, driven by a nostalgia-infused nationalism, that was crucial. He showed his appreciation. In a private meeting in early 2016, according to two people familiar with what happened there, Putin lavished praise on Nabiullina, citing disastrous cases of other big oil producers, like Venezuela, that had squandered their foreign currency reserves in futile attempts to shore up exchange rates.

It might seem obvious, given the pace of the purge, that Nabiullina has Putin’s explicit blessing. “Nabiullina is a person of character, but there’s no way she could have taken such a tough line without the support of the head of state,” says Lebedev, the banker and former legislator. “The president gave her carte blanche.” But absolute certainty is a rare commodity in Russia. People familiar with the situation say that while Putin hasn’t publicly questioned her bank crackdown, he also hasn’t explicitly given her the kind of sweeping authority to close banks at will. That, these people say, leaves Nabiullina in a less than rock-solid position—one of confidence tinged with uncertainty about whether the next one she hits could prove too politically hot.

Russia’s banking mess dates to the 1990s,

when the country lurched toward capitalism. Banks proliferated by the

hundreds, profiting from speculation in currency and other markets

rather than the more solid foundation of lending. By the middle of the

decade, the number of banks had peaked at more than 2,500. Many became

conduits for illicit activity, funneling money offshore or into cash for

off-the-books operations—including payoffs, clandestine political

funding, and organized crime. The first major efforts to crack down on

crime came in the early 2000s as Russia transitioned into the Putin era

from the free-for-all for wealth under Boris Yeltsin. But progress was

slow and resistance high.

Pavel Medvedev, a former legislator

who’s now an adviser to the central bank, recalled that shortly before

Kozlov’s murder in 2006, the regulation chief complained that whenever

he tried to move on a bank suspected of illicit activity, he’d get

threatening calls from powerful people imploring him to back off. “I

remember sitting in his office, and he pointed to the old vertushka,”

Medvedev says, referring to the special phone installed on the desks

of government officials. Medvedev remembers Kozlov saying, “As soon as

you take away a license, you get a call.” Kozlov “didn’t live long after

that,” he says.For a while, the heat was all but off the banks. “We understood that the withdrawal of a license meant big losses,” says Gennady Melikyan, who took over Kozlov’s job. But the rot inside the banking system was an open secret. Shortly before Nabiullina took over as central banker in the spring of 2013, her predecessor, Ignatiev, gave a valedictory interview to a local newspaper. He said a massive $49 billion in illicit flows sapped the economy of capital and much-needed tax payments and that more than half that amount was attributable to interconnected companies. “You get the impression that they are all controlled by a single, well-organized group,” he said, without identifying anyone.

This story appears in the February / March 2017 issue of Bloomberg Markets.

Cover artwork: Oriol Angrill Jordà

Some were previously thought to be untouchable. One was Masterbank, a top-100 lender suspected by officials of being a prime player in the “black cash” trade, in which banks provide huge sums of money for illicit payments, often under the protection of the country’s security services. A person close to the central bank but not authorized to discuss internal matters says Nabiullina didn’t expect to set a precedent with the closure and didn’t fully realize its significance until this illicit market contracted sharply and costs shot up.

Perhaps fittingly, given Russia’s reputation for corrupt business practices, the “black cash” trade carried on, according to several senior bankers. The banks just charged more for it.

With oil collapsing

and sanctions limiting international financing, 2014 was a make-or-break

year for Putin’s economy—and Nabiullina’s banks. The ruble lost almost

half its value against the dollar, and the economy plunged into

recession as inflation spiked. With bigger banks being swept into the

maelstrom, the central bank had to find ways to keep struggling

institutions afloat. That meant enticing other banks to take them over

with cheap financing.

Even veteran regulators were shocked at the hole they found in the bank’s books. Among other assets, the bank had claimed it had an account at Citibank that held $50 million. Investigators said the actual balance was $10,000. Vneshprombank had simply forged records using a copy machine, according to testimony at a parliamentary hearing the following month.

Photographer: Arthur Bondar for Bloomberg Markets

But that required Putin’s support. Once she got it, she laid down the law to bankers at the conference in June, even before she’d gone to the government with the plan. “The problems banks accumulated turned out to be greater than we expected,” she said. The entire supervision system needed a “radical overhaul.” The central bank needed to act quicker to prevent problems before they arose, not afterward. The old system for rescuing failing banks—recruiting healthier ones to come in as investors—wasn’t working, she acknowledged. “As a rule,” she continued, “the investors don’t put money into the capital of the rescued bank, don’t always develop its business, and sometimes use its balance sheet for bad debts, putting a significant share of the funds received for rescue into their own projects.”

Nabiullina began to make changes. The central bank tightened supervision of big players, digging into their often-complex links to companies controlled by the banks’ wealthy shareholders. Last fall she ousted the two top officials who’d handled bank supervision for decades. Sitting on a panel with Nabiullina shortly afterward, Putin criticized the regulator for not moving faster with the cleanup in past years. “Better late than never,” he said. To clear out the rot of bad loans, the regulator now requires banks to make provisions for losses when it deems risks could be high. Under the new plan, when a bank is struggling, the central bank will take it over, turning the regulator into owner and manager as well. She’s even asked Putin to consider amending Russian law to prevent suspect bankers from fleeing the country. (He told her he would think it over, according to a Kremlin transcript of the conversation.)

All of this leaves Nabiullina with a big, virtual “The Buck Stops Here” sign on her desk. Nabiullina contends there’s no way the regulator could have caught a lot of the fraud at banks that ultimately failed unless the banks themselves fessed up. She isn’t encouraged by the history of Russian banking. “Unlike our colleagues in other countries, we have to determine when we are being lied to,” she told a Russian magazine late last year. Pointing to Russian bankers, she said, “They fake the numbers, strip the assets, flee the country, and stay there with the money of creditors and the state and don’t face any punishment.” In January her newly installed bank-supervision chief told a local news agency that the banking cleanup could take another three to five years.Nabiullina can’t turn things around without help from her boss. So far, she seems to have it. In December, at Putin’s annual marathon press conference, a reporter from a region where a troubled major bank had recently been taken over by regulators quizzed him about the impact on customers. The president left no doubt about where he stood. “There’s nobody who thinks that the central bank, in cleaning up the financial system, is making a mistake,” he said. “Just nobody.”

Pismennaya covers economic policy for Bloomberg News in Moscow. White is an editor also based in Moscow. With Ilya Arkhipov and Andrey Biryukov

Nessun commento:

Posta un commento