Is Europe over (central)banked?

Many national central banks in the euro area have shed staff in the two decades since they ceded many of their responsibilities to the ECB. Yet they still look flabby: the central banks of Germany, France and Italy have many more employees than the Bank of England, whose duties have grown over the same period.The size of some of the national central banks, more than 21 years on from the euro’s introduction, is staggering. Here are the figures, put together by Central Banking Publications, a trade journal:

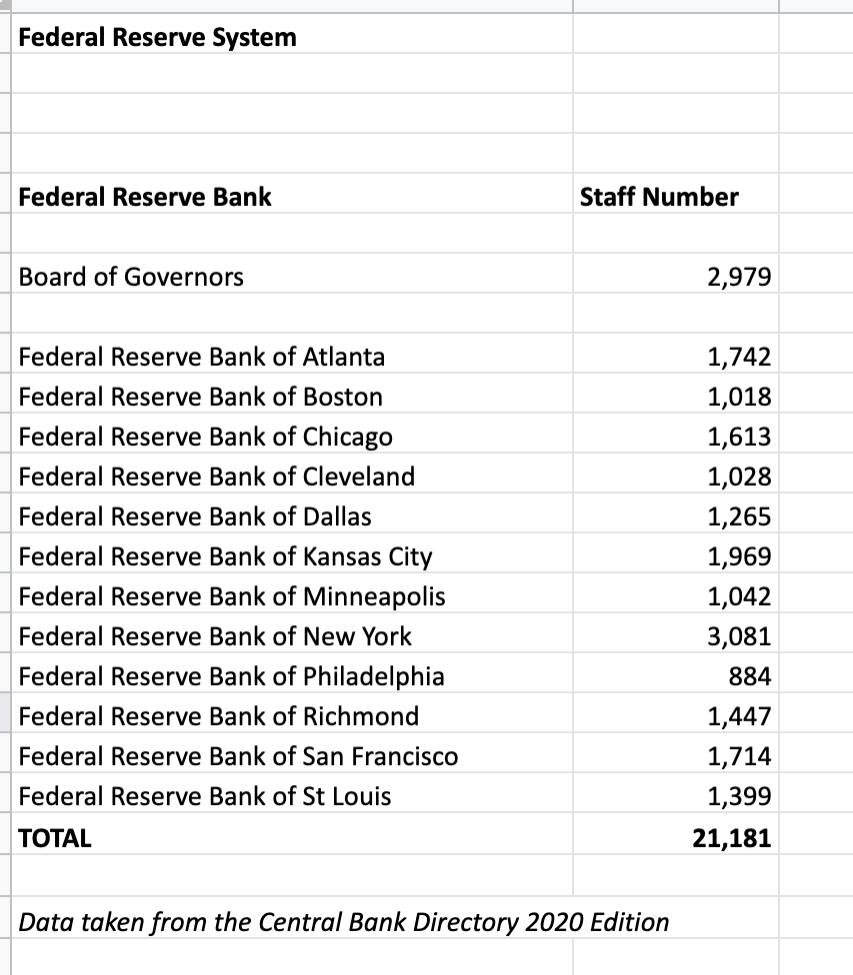

The Federal Reserve in Washington and the 12 regional Feds dotted around the country do employ more than 21,000 (again, the figures are from Central Banking Publications):

The numbers in Europe have, it must be said, fallen back, often through painful closures of local central banks – the Banque de France, for instance, has gone from having 211 branches dotted around the country to 95 today. But still, that’s a lot more than the 12 agencies the BoE has.

Europe’s central banks, forever calling on member states to make painful structural reforms to their economies, might want to take a closer look inside their own corridors.

Nessun commento:

Posta un commento