Former Fed Chief Found Economists “Useless,” New Book Says

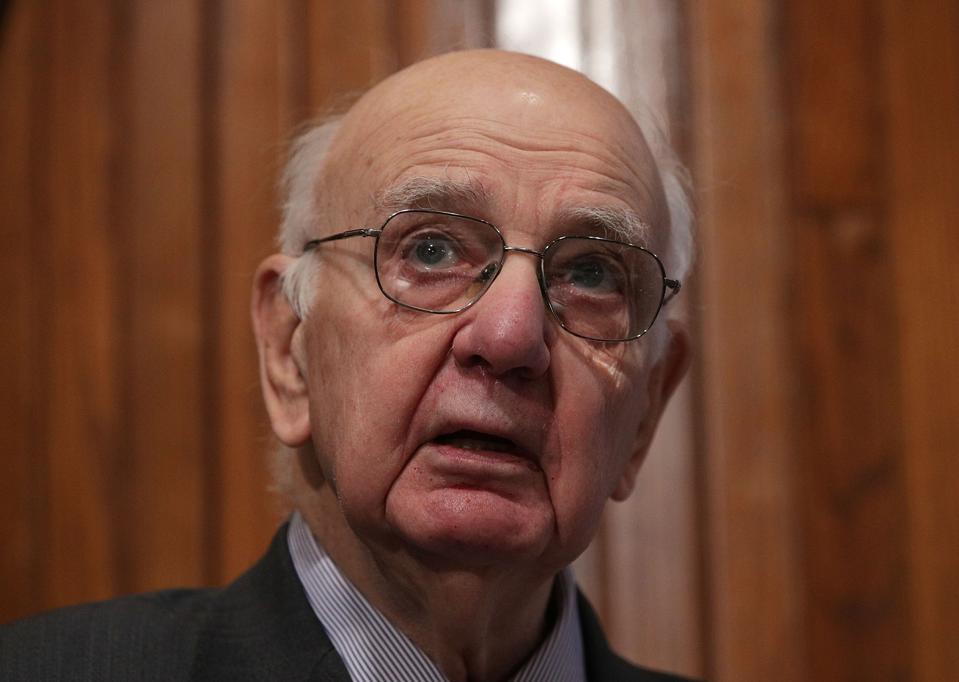

WASHINGTON, DC - DECEMBER 05: Former Chairman of Federal Reserve Paul Volcker speaks at a Volcker ... [+]

Getty Images

One of the most storied economists of the twentieth century thought economists were "useless!"

The man in question might surprise some people including hordes of Wall Street investors.It was the late Paul Volcker, one-time head of the Federal Reserve and a near-fixture of the economics establishment for the past few decades.

The main problem with economists, Volcker said, was their inability to make accurate forecasts, according to an interview he gave to Simon Bowmaker, author of the recently published book, "When the President Calls: Conversations With Economic Policymakers."

"During my lifetime, the subject has become much more mathematical, much more abstract, and much more useless in terms of contributing to effective public policy," Volcker told Bowmaker in an interview for the book.

...the subject has become much more mathematical, much more abstract, and much more useless...

A big part of his beef wasn't the focus on number crunching itself, but rather that the numerical analysis wasn't any good for making predictions about the economy. At least the people he worked with weren't any good at it.

"There are some horrendous examples [of forecasting failure], with the recent financial crisis being the most obvious one," Volcker said. "There are hundreds of economists poring over their computers, but I think they have just demonstrated their inability to be forecasters."

That was true in the run up to the financial crisis a little over a decade ago, and it was in the late 1970s.

False Recession Alarm in 1979

The former Fed chief noted the bizarre time when in 1979, economists repeatedly told him that the U.S. was either headed for a recession or was actually in one."There was no recession," he said. "But when you receive those forecasts from your staff, what do you do?"

Such scares put him in a tough spot when deciding on monetary policy.

"I resent it," he said.

Volcker noted that there was a "phony recession" a year later in February 1980. The fake slump got caused by government-imposed credit controls, and the pullback reversed immediately when the constraint got lifted.

In the interview with Bowmaker, Volcker seemed to call on academic economics wizards to get out of their ivory towers and learn about the real world.

"Economists who have been in government should become better economists," Volcker said. "They now have a feel for the real world."

Or put another way, practical knowledge of how economic policy gets made could go a long way to make the profession better.

Nessun commento:

Posta un commento