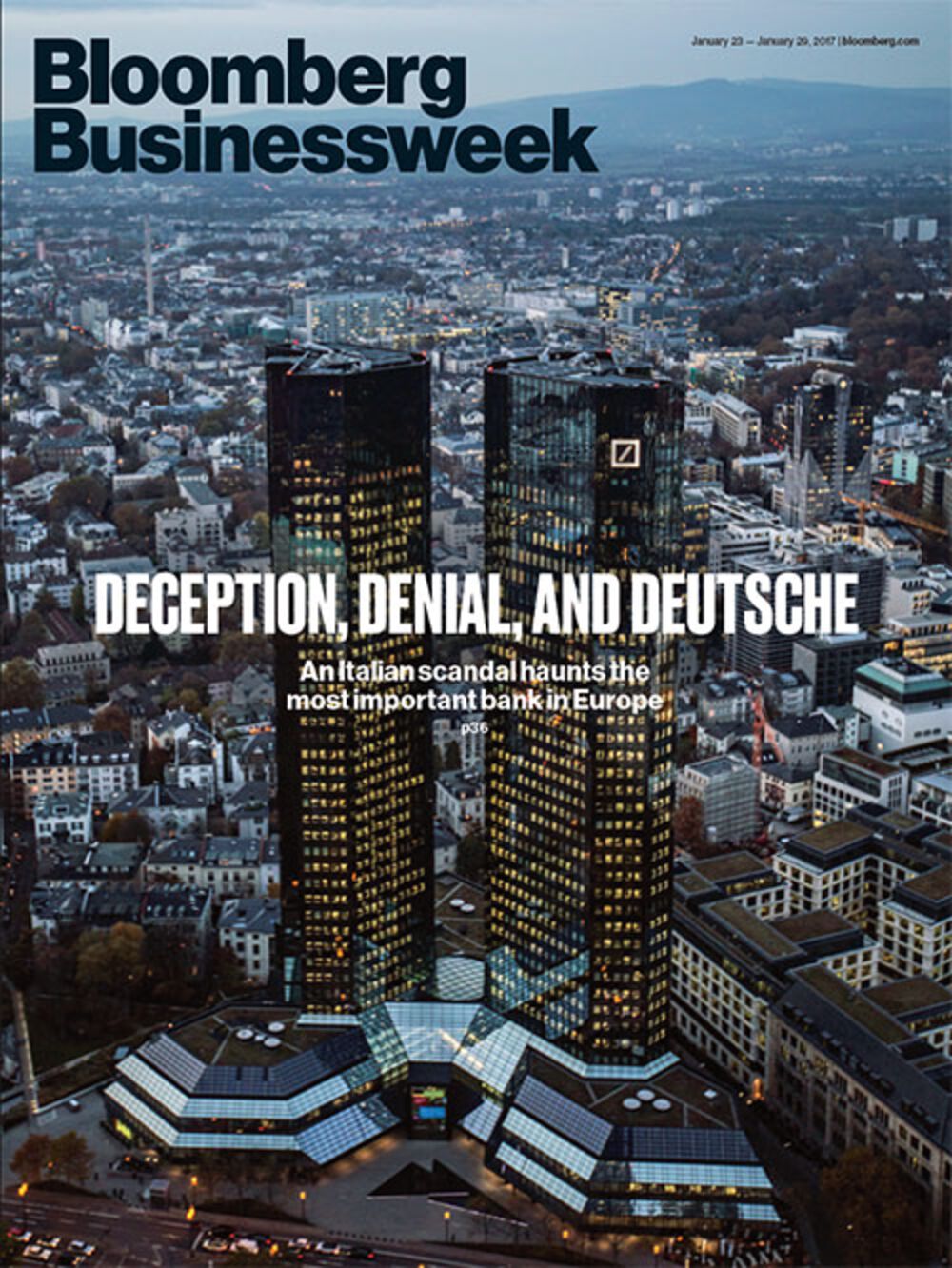

Photographer: Krisztian Bocsi/Bloomberg

How Deutsche Bank Made a $462 Million Loss Disappear

A dubious trade leads to a criminal trial for Europe’s most important bank.

On Dec. 1, 2008, most of the

world’s banks were still panicking through the financial crisis. Lehman

Brothers had collapsed. Merrill Lynch had been sold. Citigroup and

others had required multibillion-dollar bailouts to survive. But not

every institution appeared to be in free fall. That afternoon, at the

London outpost of Deutsche Bank, the stolid-seeming, €2 trillion German

powerhouse, a group of financiers met to consider a proposal from a team

led by a trim, 40-year-old banker named Michele Faissola.

The

scion of an Italian banking family, Faissola was the head of Deutsche’s

global rates unit, a division that created and sold financial

instruments tied to interest rates. He’d been studying the problems of

one of Deutsche’s clients, Italy’s Banca Monte dei Paschi di Siena,

which, as the crisis raged, was down €367 million ($462 million at the

time) on a single investment. Losing that much money was bad; having to

include it in the bank’s yearend report to the public, as required by

Italian law, was arguably much worse. Monte dei Paschi was the world’s

oldest bank. It had been operating since 1472, not long after the

invention of the printing press, when the Black Death was still a living

memory. If investors were to find out the extent of its losses in the

2008 credit crisis, the consequences would be unpredictable and grave: a

run on the bank, a government takeover, or worse. At the Deutsche

meeting, Faissola’s team said it had come up with a miraculous solution:

a new trade that would make Paschi’s loss disappear.

Featured in Bloomberg Businessweek, Jan. 23-Jan. 29 2017. Subscribe now.

Photographer: Ulrich Baumgarten/Getty Images

The audience for the proposal that day was Deutsche’s global market risks assessment committee, a top-level panel that reviews transactions with legal, regulatory, and reputational considerations. Respectively, that means asking: Is a given trade within the law? Is it within the looser framework of industry rules and standards? And even if so, can Deutsche pull it off without maiming its brand—its basic ability to operate as a trustworthy member of the global financial system?

To at least one member of the committee, the possibilities of Faissola’s trade seemed wondrous. “This is fantastic,” said Jeremy Bailey, Deutsche’s European chairman of global banking, according to testimony of an executive who later recounted the exchange for an internal disciplinary panel. “You can book a [profit] in front and spread losses over time?” Bailey added. “We should do it for Deutsche Bank.”

Ivor Dunbar, the meeting’s chairman, curbed Bailey’s enthusiasm. “We are not discussing [our] balance sheet here,” he said. (Bailey, through a spokesman, denies he made the remarks.)

Outside the room, one of Faissola’s longtime colleagues was raising questions about the deal. William Broeksmit, a managing director who specialized in risk optimization, was concerned about the winner-loser construction. A Chicago-born son of a United Church of Christ minister, Broeksmit had decades earlier been a pioneer in interest rate swaps, the financial instruments that had rewritten the possibilities—and profitability—of investment banking. But Broeksmit, 53, was also against reckless derivative deals, which is how he viewed Faissola’s proposal, according to a person familiar with his thinking. Eleven minutes after the meeting began, Broeksmit e-mailed one of its attendees with a warning about the Paschi trade and its “reputational risks.”

Eight years after the financial crisis, the stakes could hardly be higher. Being the biggest bank in Germany makes Deutsche the most important bank in Europe, and the Paschi trial is an uncomfortable reminder that its operations, already with barely enough capital to meet industry standards, are threatened by persistent scandal. Deutsche is also facing investigations into whether it helped clients launder billions out of Russia. This month the bank agreed to pay $7.2 billion to resolve a U.S. probe into its subprime mortgage business, admitting it misled investors. Deutsche has paid more than $9 billion in further fines and settlements related to claims of tax evasion; violating sanctions against Iran, Libya, Syria, Myanmar, and Sudan; rigging the $300 trillion Libor market; and other alleged breaches of the law.

The strain has intensified concerns about Deutsche’s balance sheet, which contains one of the world’s largest pots of most-difficult-to-quantify risk. The bank says it’s trimmed some of its exposure, as John Cryan, who became chief executive officer in 2015, attempts to clean up his predecessors’ messes. But if Deutsche ever requires government help, such as a bailout, the effects could be catastrophic for more than shareholders. In recent years, as the euro community has faced one solvency problem after another in Greece, Portugal, and elsewhere, Germany’s Angela Merkel has been chief scold. She’s insisted on fiscal pain for irresponsible actors and pushed for banking rules that keep taxpayers from picking up the bills again for reckless financiers. Her government coming to the aid of Deutsche Bank after lecturing others on restraint would be the ultimate euro zone irony. In a worst-case scenario, it could trigger a furor that finally brings down the continent’s currency, already made fragile by Brexit, refugees, and the rise of nationalist politicians.

The bank’s deal with Paschi is a microcosm of how Deutsche’s embrace of derivatives, questionable accounting, and slow-walking of regulators have eroded the market’s trust to the point that no one really knows how close the company is to the edge. What exactly happened in the days surrounding the December 2008 meeting in London is key to the Italian prosecution. The German financial-markets regulator, known as BaFin, already tried to get to the bottom of the matter, commissioning an independent audit in January 2014.

The ensuing report has never been made public, but Bloomberg Businessweek obtained a copy. It shows that auditors asked Faissola what happened that afternoon in London. Other participants recalled details and dialogue, the report says, but Faissola drew a blank about the event he’d helped run. Broeksmit wasn’t interviewed. On Jan. 26, 2014, the day before the audit began, his body was found at his London home, hanging from a dog leash.

Founded in 1870, Deutsche Bank was for most

of its existence content to take deposits and make loans; in the 1920s

it participated in the founding of the airline Lufthansa and the merger

of automakers Daimler and Benz. Then, in the 1980s and ’90s, Deutsche

watched as rival lenders in London and across the U.S. turbocharged

profit growth by snapping up boutique investment banks and hiring or

building teams to sell higher-margin financial products. To join the

bonanza, Deutsche in 1995 hired one of its leaders from Merrill Lynch:

Edson Mitchell, a redheaded chain smoker from Maine who was nurturing a

team of future financial leaders. His crew included Broeksmit, the swaps

innovator, and Anshu Jain, a prodigy at selling such risky, fee-laden

products to hedge funds. Three years later, Deutsche made an even more

emphatic attempt to buy its way into investment banking’s culture and

profits, acquiring Bankers Trust—a New York derivatives house notorious

for its cowboy culture—for about $10 billion.

If longtime Wall

Streeters gawked at first at the German interloper, they quickly

recognized that Deutsche had adopted their aggression and then some:

Mitchell and his deputies expanded Deutsche’s London-based investment

banking operation until it made half the bank’s revenue by the turn of

the century.

Faissola represented the next generation in Deutsche’s investment banking push. He was born in 1968 in Sanremo, the coastal town whose legendary song contest launched the tune Volare, and his uncle was president of the Italian banking association. While running Deutsche’s global rates division in London for Jain, Faissola built his own fortune, at times earning tens of millions of pounds a year. He drew the jealousy of British co-workers because, as a foreigner, he was able to legally avoid U.K. tax on his bonuses. Faissola’s town house in Chelsea featured an indoor pool.

In the first years of the millennium, Deutsche bankers chased new sources of riches around the globe. People who piled into uncharted areas or pushed the rules were rewarded handsomely. Starting in 2005, Deutsche traders in Europe, North America, and Asia manipulated a benchmark interest rate to benefit their own derivative bets, according to an indictment made public last year in federal court in New York City. Deutsche’s most profitable derivatives trader earned a bonus of almost £90 million (then $130 million) in 2008 alone. Deutsche bankers also increased their bonuses in the runup to the crisis by creating and selling to clients mortgage securities that were marketed as high-quality investments but were in fact loaded with home loans destined to go bust. For clients, Deutsche became a go-to bank when they wanted risk and complexity.

In May 2002, when it was 530 years old,

Monte dei Paschi asked Deutsche Bank to sell it something complicated.

Paschi had recently listed its shares on the Italian stock exchange and

was under pressure to grow. It owned a piece of another bank known today

as Intesa Sanpaolo and wanted to convert some of that stake into cash

for acquisitions, while still benefiting from any rise in Intesa’s

shares—a kind of have-cake-and-eat-it-too arrangement. It was exactly

the kind of bespoke financial product the new, risk-friendly Deutsche

was growing fat on. The two banks created a venture called Santorini

Investments—essentially, a derivative bet in the form of a company. The

bet would pay off if Intesa shares rose and would lose value if they

fell. Later restructuring made Paschi the sole shareholder.

The

switch meant that in 2008, when bank stocks tanked in the worldwide

financial crisis, Paschi took all of the losses, which swelled from €180

million in early October to more than €300 million in the following

weeks. The bank’s own shares were on their way to losing half their

value since the start of the year. If Paschi included the Santorini loss

in its Dec. 31 reports, the consequences would be dire: Italy’s central

bank could take over its administration or force a bailout that would

wrest control from its owners, a politically connected Siena foundation.

As the losses grew, Deutsche executives knew time was running out for

Paschi to find a solution. Having done the first deal, they went to

Paschi management with a proposal for a second that would both help the

Tuscan bank and be a new source of fees for Faissola’s group. On Nov. 3

they sent Paschi draft contracts for the sure-to-win/sure-to-lose trade

that straddled the new year. Each prong of the bet simply wagered on an

index that was the exact inverse of the other. Essentially, the trade

had little economic purpose—only an accounting one.That’s typically a red flag to auditors and regulators, and it took almost a month for Deutsche to alter the deal so it contained a small amount of actual risk. The bankers did this by mixing in two interest rate triggers—that is, prices to be fed into a formula that would determine how much money the participants in the trade had to pay or receive from each other. But that created a slight possibility that Paschi could win both sides of the bet. To mitigate this potential Deutsche loss—as much as €500 million—Deutsche added a third trigger. Underlying the now complex flowcharts of rates, payments, and triggering events was the asset on which the transactions were to be based: about €2 billion in Italian government bonds.

By Dec. 1, 2008, Faissola’s group was ready to present the deal to Deutsche’s risks assessment committee, which sent it along to a final bureaucratic stage: the market risk management approval committee, where Broeksmit had influence. Top management had just handed Broeksmit broad authority to police risk across the firm, rehiring him after he’d taken a hiatus as a consultant. Michele Foresti, a managing director who reported to Faissola, e-mailed Broeksmit on Dec. 2, copying his boss. “I understand market risk management doesn’t want to give us green light to close this transaction,” Foresti wrote, noting the small chance of a €500 million loss. “I feel the risks are important but we should be able to manage them, could we sit down to discuss as soon as you have 5 mins?” Broeksmit’s reply was terse: “I think this should be presented to Anshu.”

Anshu Jain was by then co-head of investment banking at Deutsche. Foresti sent another e-mail at 3:52 p.m. the next day: “still waiting for [committee] approval, faissola is in anshu’s office.” What, if anything, Jain knew about the deal was an avenue later explored in the German regulator BaFin’s audit. It found no evidence to suggest Jain was aware of the transaction and couldn’t conclude whether he’d been involved in its approval. Jain told the inquiry that he wasn’t part of that process, though he couldn’t rule out having heard about the Paschi transaction in a general meeting. Faissola said he couldn’t recall having talked with Jain about the transaction. Faissola could have been in Jain’s office for many reasons. (Jain declined to comment for this article. Foresti, who’s a defendant in the Milan case, also declined to comment.)

Deutsche’s risk committee signed off on the Santorini project by the end of the day, after first securing a concession that Paschi would sign a memo pledging to inform its own auditors about the deal and consult its own legal and accounting advisers. The two parties executed the first part of the trade that night by phone, and the rest of the paperwork was signed over the following two days.

The deal allowed Paschi an immediate gain of €364.1 million, neutralizing the derivative loss. Deutsche netted about €60 million in fees, according to documents seen by Bloomberg Businessweek. Internally, the profits were credited to Faissola’s unit.

Deutsche also benefited from the way it accounted internally for its side of the deal. That complex shuttling of Italian bonds? The bank decided that all of the back-and-forth maneuvers canceled themselves out and did not need to appear on its balance sheet. Deutsche began to apply the practice to transactions around the world, totaling more than $10 billion that never showed up on its books and making the bank look smaller and less risky than it really was. In September 2009, it was Broeksmit again who took notice. In an e-mail about a similar deal, he wrote that such accounting techniques “may be a rounding error at this point, but [they are] growing quickly.”

An anonymous whistle-blower

contacted Italian authorities and the U.S. Federal Reserve about

Santorini, and they started parallel probes in 2011. In the fourth

quarter of that year, Deutsche appeared to resist the Fed’s questions,

and likely because of the delays and insufficient replies—according to

the BaFin audit—the Fed issued a subpoena in April 2012.

Jain was

promoted to co-CEO the next month. He proposed Broeksmit as the new

chief risk officer, but had to back off after BaFin objected, noting

that he’d never managed a large number of employees. Broeksmit retired

in February 2013—out of the bank, but well aware of the mounting

investigations into the Deutsche-Paschi deal. In subsequent months he

complained to a psychiatrist that he was suffering from anxiety about

being investigated.At the same time, Santorini exploded in Italy as a national scandal. In January 2013, Bloomberg News reported that Paschi executives had used the deal to improperly obscure losses—provoking criminal investigations, tanking the bank’s stock, and, in February 2013, leading to a government bailout of €4.07 billion.

Several months after Rossi’s death, in January 2014, Broeksmit was supposed to meet his wife of almost 30 years at a cafe near their home in the South Kensington neighborhood of London. He didn’t show. When she returned home, she found his body hanging from the leash attached to a door. In a dog bed, he’d left suicide notes, including one addressed to Jain, his longtime colleague. The New York Post reported last year that the note to Jain contained an apology. A summary of Deutsche Bank’s own review of the suicide, seen by Bloomberg Businessweek, doesn’t mention the note and says the review found no direct link between Broeksmit’s death and his work at Deutsche.

BaFin’s auditors interviewed Faissola on

Aug. 28, 2014. He told them he couldn’t recall details of the period in

which the Santorini deal closed. Faissola also said he couldn’t recall

telling Deutsche’s lawyers in 2012 that the transaction could be

characterized as “window dressing” Paschi’s financials, as another

source had told the investigators.

Faissola laid blame on Paschi

and defended his role. “Nobody could have anticipated that the top

management of a top European bank, fully regulated, with credible

advisors and auditors, had allegedly ‘crooks’ on the board,” he told

auditors hired by BaFin. Faissola left Deutsche Bank in 2015, as did

Jain and his co-CEO, Jürgen Fitschen. (Neither Jain nor Fitschen is

accused in the Italian case.)In February 2016, Deutsche said BaFin had closed its inquiries into Paschi and other matters, pointing to changes the bank had implemented and further measures it planned to take. An overhaul of the management board and the departure of senior executives contributed to the regulator’s assessment that the company had done enough, a person with knowledge of the matter said at the time.

On Oct. 1, 2016, a judge in Milan handed down his indictment in the Santorini affair. The trial, which began with an initial hearing in December, is expected to run throughout 2017. Doubts about the financial health of Deutsche Bank have eased, but the stock is still about 80 percent below its 2007 high, and with legal costs uncertain, management hasn’t ruled out needing to raise more capital. New CEO Cryan is expected to introduce a strategy as soon as February, when the bank announces its final 2016 results, which analysts estimate will barely show a profit. Brought in to right the ship, Cryan has been contrite. “We didn’t always control ourselves,” he said at a Davos panel on Jan. 17. And those big bonuses? Gone. Senior employees won’t be getting any for the last year.

Meanwhile, Paschi is about to be nationalized in the biggest bank takeover by the state since the 1930s. And Faissola has kept busy. After his resignation he founded an investment company, based in Jersey in the Channel Islands, called F.A.B. Partners. The F stands for Faissola. It counts among its clients the Qatari government. With a stake of almost 10 percent, the regime is the biggest shareholder in Deutsche Bank. According to recent reports, Faissola’s latest project is advising the Qataris on whether to boost that position—and extend his former employer a lifeline.

—With Matt Scully, Donal Griffin, and Ambereen Choudhury

Nessun commento:

Posta un commento