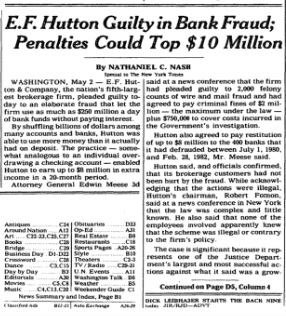

JPMorgan Chase is ritually fined for criminal conduct by the US Department of Justice (like it happens also to other banks), but this don't seems to be enough to stop their criminal stance. Why ?

by Marco Saba, Forensic Accountant, Italian Colony, October 31, 2020

Italian version localized here: CARIGE: misteri di Banca spiegati al pubblico e agli azionisti

"In a departure from Swiss GAAP FER, no cash flow statement has been prepared."

- Swiss National Bank, page 158 of the 2016 Report

The main activity of banks today is deposit creation (money creation). That deposits are money (cash) is stated in the international accounting rules. Under international accounting standards, the definition of cash is cash on hand and demand deposits (IAS-IFRS 7.6 and US GAAP ASC 942-230-20 Glossary). For example, a bank’s granting of a loan by crediting the proceeds to a customer’s demand deposit account is a cash payment by the bank and a cash receipt of the customer when the entry is made.

GAAP ASC 942-230-20 Glossary

Cash

Consistent with common usage, cash includes not only currency on hand but demand deposits with banks or other financial institutions. Cash also includes other kinds of accounts that have the general characteristics of demand deposits in that the customer may deposit additional funds at any time and also effectively may withdraw funds at any time without prior notice or penalty. All charges and credits to those accounts are cash receipts or payments to both the entity owning the account and the bank holding it. For example, a bank’s granting of a loan by crediting the proceeds to a customer’s demand deposit account is a cash payment by the bank and a cash receipt of the customer when the entry is made.

What people know:

" How Bank Deposits Work

The deposit itself is a liability owed by the bank to the depositor. Bank deposits refer to this liability rather than to the actual funds that have been deposited. When someone opens a bank account and makes a cash deposit, he surrenders the legal title to the cash, and it becomes an asset of the bank (unrecorded). In turn, the account is a liability to the bank (recorded). " (Italics mine) https://www.investopedia.com/terms/b/bank-deposits.asp

While the liability is recorded as DEPOSITS in the LIABILITIES side of the CONSOLIDATED BALANCE SHEETS - highlighted below in the JPM-CHASE 2019 Annual Report audited by PWC - i.e. $1,562,431 million, the corresponding ASSET don't appear in the ASSETS side of the balance (Page 148 of the original Annual Report). That's why I wrote above UNRECORDED and RECORDED in the investopedia definition.

The appropriation of the client deposits by the JPMorgan Chase bank don't appear either in the CONSOLIDATED STATEMENTS OF CASH FLOWS (see the highlighted NET CASH PROVIDED BY FINANCING ACTIVITY below, just $32,987 million...). Page 150 of the original annual report.

So now we understand that the monetary deposit (cash, under GAAP) created by the bank is not recorded anywhere in the report. Deposit creation happens when a bank make a loan or a mortgage to a client, anytime. As the bank appropriate the client deposit, the client maintain the "withdrawal rights" (the liabilities) but the asset counterpart is hidden to accounting. If my thesis is correct, i.e. that the STATEMENTS OF CASH FLOWS are adulterated not including the "loan" that the client do to the bank as "financing activity", then we can solve a very old mystery... Why can't we determine the real wealth status of a bank by simply looking at the Statement of Cash Flows like we do for any other commercial company ?

1. Zhan Gao , Weijia Li, John O’Hanlon, The informativeness of U.S. banks’ statements of cash flows, Journal of Accounting Literature, Volume 43, December 2019, pp. 1-18

https://www.sciencedirect.com/science/article/pii/S0737460718300624

2. Proff. Charles W. Mulford, Eugene E. Comiskey, Cash Flow Reporting by Financial Companies: A Look at the Commercial Banks, Georgia Tech College of Management, July 2009

https://smartech.gatech.edu/handle/1853/29098

(Further literature here: https://centralerischibanche.blogspot.com/2018/11/bibliografia-sulla-questione-contabile.html )

Now it is easy for the reader to understand that by absconding to the public the revenue of deposit creation (the deposit appropriation activity), that in the case of JPMorgan is in excess of $1,56 trillion, the whole banking system - by menacing a nonexistent and impossible bankruptcy - can blackmail the U.S. System forever asking for MORE EASING. At the same time, by paying for fines with the deposit creation activity (i.e. just by simply creating a brand new deposit), the bank don't suffer any pain. The real banking profits are hidden to the public forever.

To give a layman's example: it would be as if a restaurateur were pretending to balance his balance sheet by counting as assets only the tips he receives from his clients (the interest) and not the total balance of the bill he presents to the table (the capital). It is obvious that the restaurant will never be saved, and even increasing its capital (as the requirements of the Bank for International Settlements, the so-called Basel 1, Basel 2, Basel 3 and, then, Basel 4, continually demand) does not cure the accounting pandemic that afflicts the banking system today.

Question: So the whole operation of the primary dealers can be reinterpreted as a gigantic money creation/money laundering operation ? (T-Bonds are bought by creating new deposits)

Answer: Sure.

In Italy we are in the range of EUR 1,000 billion each year as the aggregate commercial bank deposit creation, more than the State budget (which is around 900 B / Year).

One may ask where those enormous funds ends up and by what channel are laundered. But that's a good question for another Deep State story.

(Hint: Clearing Houses. Historical hint: the original Charles Ponzi intended to unveil the system...)

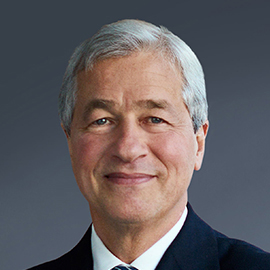

Jamie Dimon, Chairman & CEO of JPMorgan Chase & Co.